False Account Entries

Fake Account Entries refer to the input of wrong or misleading information in terms of financial statements. It is ethically wrong to include fake account entries in software or in a book that has to be submitted to a financial manager.

False Data

False data refers to information which is not accurate, especially the information which, in a specific context, differs directly from the required information.

False Declines

False declines are generally referred to as false positives that occur when an actual transaction is apparently flagged by a protection system of a merchant and it is declined inadvertently. Often, it occurs when a cardholder trips into a merchant's fraud detection system.

False Documents

False documents are documents created with incorrect information that cannot be used for their required purposes because the document does not contain the necessary data. These documents are created for the purpose of deceiving others.

False Expense Claims

What are false expense claims?

Many organizations focus on external threats to fight fraud. However, internal threats can be just as devastating. Employees who feel entitled to something or who take advantage of lax policies can devise schemes to steal from your business. False expense claims are among the most common methods used.

Businesses have processes for reimbursing expenses that employees incur while on the job. These expenses can include travel costs, business lunches or supplies.

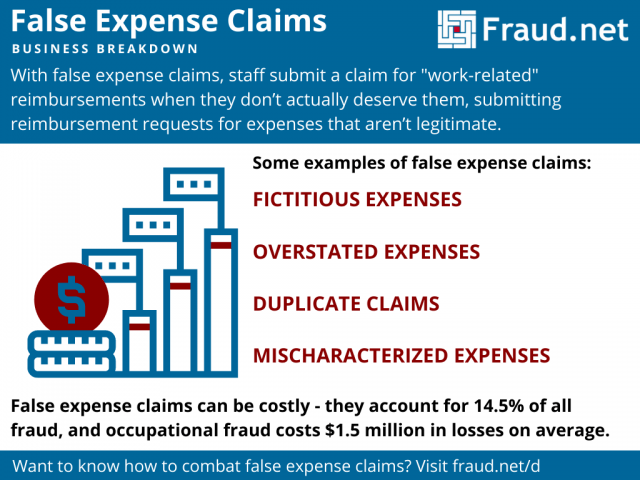

With false expense claims, staff - who are authorized to be reimbursed for a certain number of expenses incurred while carrying out their work duties - submit a claim for those reimbursements when they don’t actually deserve them. Essentially, they take advantage of this practice to submit reimbursement requests for expenses that aren’t legitimate.

This type of fraud can take on different forms:

- Fictitious expenses. Employees can use fake receipts or fill out blank receipts to claim they purchased something for work and get reimbursed. They can also submit a claim for trips they canceled.

- Overstated expenses. With overstated expense reports, employees claim they spent more than they actually did. They can, for instance, say they tipped more or fail to report that an item was discounted.

- Duplicate claims. It’s possible to use the same receipt or invoice more than once to submit multiple expense reports. This scheme can be hard to notice if your HR or accounting department is busy.

- Mischaracterized expenses. This scheme is one of the common types of false expense claims. Some mischaracterized expenses are legitimate errors because there are no clear policies for what the business will reimburse, but others are malicious claims from employees disguising personal purchases as business-related expenses.

How can false expense claims affect your business?

False expense claims are more common than you might think. After all, internal agents commit 37% of all fraud. Plus, 14.5% of all fraud is expense fraud. Indeed, it’s a costly issue since occupational fraud schemes cause $1.5 million in losses on average.

There are steps you can take to protect your organization from false expense reports, starting with reviewing your current policies for issuing reimbursements.

Stronger controls can make it harder to get past the employees who approve expenses. Having more than one employee involved, establishing who has the permission to issue a reimbursement, and escalating the request to a higher-level employee for claims above a certain amount can make it more difficult to submit false expense claims.

You should also go over your expense and reimbursement policies and update them. Create a list of allowable expenses and spending limits. Determine the reimbursement rate for mileage and list the documents employees will have to submit as proof. Review these rules regularly and adjust allowances to account for inflation.

Consider adopting company credit cards to oversee what employees spend instead of relying on receipts alone. You can also create a strong deterrent against internal fraud by implementing random audits of reimbursement requests.

Enforcing disciplinary measures if you find an employee to have submitted a false expense claim is another strong deterrent. Training can also increase awareness for this type of fraud and create a company culture where employees are more likely to report internal fraud.

False expense claims can be a costly issue. Besides, they can slow down the process of reimbursing legitimate business expenses. You can go further to save time and money by leveraging tech to create an additional layer of security.

How technology can help

You can build a more streamlined reimbursement process by doing away with paper receipts and adopting email to submit reimbursement requests. With Fraud.net’s Email AI tool, recipients will see a risk score for each email they receive and will know right away if a claim has been falsified.

Adopting our Transaction AI tool is another step you can take to protect your organization from false expense claims. This tool can detect fraudulent transactions by leveraging third-party APIs, our Collective Intelligence Network, and data from dynamic device fingerprinting to track users’ behaviors.

Don’t let false expense claims hurt your bottom line. Take action now and install Fraud.net's Email AI for free. And don't forget to take advantage of a free fraud analysis to create a stronger defense against all kinds of fraudulent activities.

False Expense Reimbursements

False Expense Reimbursements occur when an employee falsely inflates costs associated with their work, so that when they ask for reimbursements they will be given more money than they should.

False Financial Statements

False Financial Statements describe when a person falsifies income reports, balance sheets, and/or creates fake cash-flow statements to deceive the people who receive them. The purpose of this activity is generally personal profit.

False Front Merchants

False Front Merchants is when a company appears to have valid businesses, but actually, all are just fronts for a number of various fraud schemes. The ability of some fraudsters to make fake companies is growing with the new ways digital payment systems perform in a business, which give the opportunities for the fraudsters to set up sophisticated, deceptive schemes of false front merchants.

False Identity Fraud

What is False Identity Fraud?

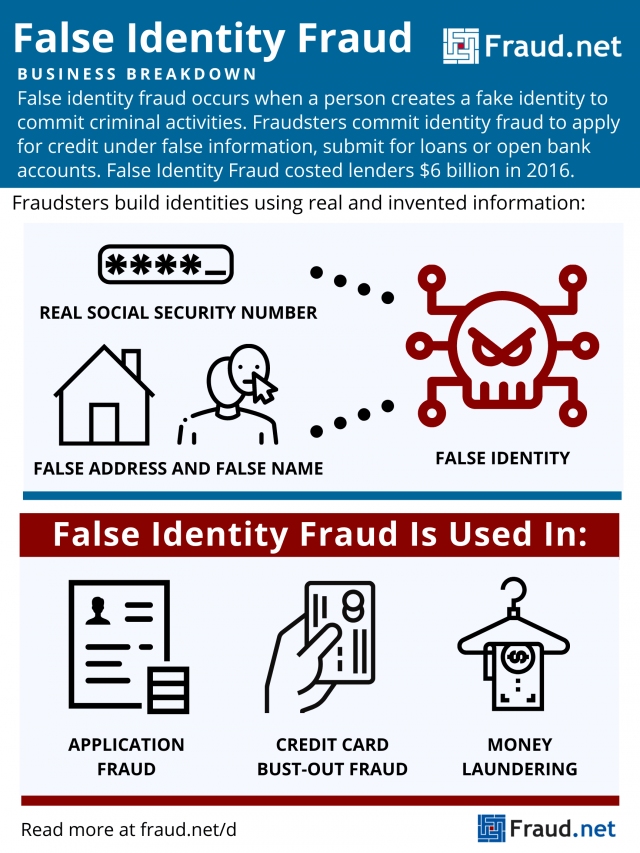

False identity fraud occurs when a person creates a fake identity to commit criminal activities. Fraudsters commit identity fraud to apply for credit under false information, submit for loans or open bank accounts.

Fraudsters obtain the information they need to construct a false identity through identity theft methods like phishing, credit card fraud, and obtaining fullz. Once they have this information, they invent some of their own rather than impersonating a living person.

For example, they may combine an existing social security number with a falsified address and name. This results in a synthetic identity they then use to commit fraud. Additionally, they may engage in social engineering to make false identities seem more legitimate, to avoid detection.

Children’s SSNs are more likely to be selected for synthetic identity fraud, as they offer a blank slate for fraudsters to build their identity upon. Additionally, false identities can be harder to discover with childrens’ SSNs, as their financial history is rarely paid attention to until the child grows older. Unfortunately, children’s identity information is often easier to obtain due to their vulnerability to phishing and other online scams.

How Do Fraudsters Use False Identities?

Fraudsters use false identities to commit a variety of fraudulent and criminal actions. They include:

- Application Fraud – Fraudsters use the good reputation (or blank slate) of an identity to apply for loans or credit cards. Then, they disappear once it comes time to pay back the loan or credit debt. An application for a credit card, even if rejected, can serve to legitimize a false identity. Afterward, a fraudster can use that legitimated identity to apply for loans and credit cards more easily.

- Credit Bust-Out Fraud – Fraudsters open new credit accounts with falsified information and establish a normal usage pattern over several months or years. Suddenly, they max out all cards with no intention of paying back the debt. Then, they repeat the process.

- Money Laundering – Criminals use false identities to engage in the trafficking of people, money, and drugs. The use of false identities allows them to avoid government detection.

- Fraud Rings – Fraudsters manage thousands of fake accounts with falsified data to commit fraud simultaneously. In these, they employ methods like bust-outs or application fraud at a large scale.

The Cost to Businesses

False identity fraud accounted for about USD $6 billion in costs to lenders in 2016 and 20% of all credit losses for financial institutions that same year – and the number is only increasing. Aite Group discovered losses of USD $820 million to synthetic identity fraud in 2018. They project that number to increase to about USD $1.25 billion over the next two years.

However, the Federal Reserve presumes that the number could be much larger, due to particular fraud detection oversights, such as lack of investigation, lack of consistency in which attributes to assess, lack of awareness, and lack of reporting.

Fraud.net has a Solution

While attempting false identity fraud is considered a felony in most jurisdictions, the volume of attacks prompts organizations to prevent false identity fraud rather than prosecute it. They do so through methods of identity verification and rules-based screening. Additionally, they may do risk-scoring to approve or deny transactions based on how high of a potential fraud risk they are.

Artificial intelligence, data mining, and machine learning provide an edge to false identity fraud protection. Institutions protect their consumers better by stopping crime in its tracks rather than reacting after the fact.

Fraud.net combines AI & deep learning, collective intelligence, rules-based decision engines, and streaming analytics to detect fraud in real-time, at scale. To learn more about the solutions we offer to stop fraud before it affects your business, click “talk to a fraud expert” below.

False Invoices

False Invoices could be described as the situation where a person makes an invoice that does not relate to a real sale or payment and is used to get money dishonestly and undeservedly.

False Negative

A false negative is when a fraudulent transaction fails to be flagged as fraudulent, and gets through a system's fraud detection. It is the opposite of a false positive.

False Positive

False Positives, also known as “false declines” or “sales insults” appear when financial organizations or merchants decline valid orders. False positives are primarily caused by a businesses anti-fraud system incorrectly marking a transaction as likely to be fraud, when in truth the order is legitimate.

False Report

A false report is created when somebody knowingly reports a crime that did not occur, or knowingly reports details of a crime incorrectly.

False Reporting

False Reporting is when someone creates documents with false financial information and submits this information as legitimate.

False Sales Invoices

A contractor or supplier may commit fraud by knowingly submitting false, inflated or duplicated invoices with the intent to defraud the company they have been hired by. The contractor may act alone, or collude with payroll staff to keep the fraud going. The expression “false invoices” refers to invoices for goods or services that were never actually provided.

False Travel Claim

A false travel claim is when a person falsely claims they traveled by a certain method, and then asks to be reimbursed for paying for that method. An example would be if an employee said they had to take public transport to get somewhere, when in reality they simply walked or biked, and just want to make the money they say they spent.

False Vendors

False Vendors refer to any scheme that is completed by creating fake vendors. This can have multiple uses for fraud; for one, the fraudster can send invoices to companies asking for payments on a service or good that was never actually provided. Another example is when a fraudster will create a duplicate payment system, causing consumers to have to pay twice to buy a good, one payment going to the fraudster.

Falsified Hours

Falsified Hours is the term for when an employee records themselves as having worked more hours than they truly have in order to be paid for work they have not done.