What are false expense claims?

Many organizations focus on external threats to fight fraud. However, internal threats can be just as devastating. Employees who feel entitled to something or who take advantage of lax policies can devise schemes to steal from your business. False expense claims are among the most common methods used.

Businesses have processes for reimbursing expenses that employees incur while on the job. These expenses can include travel costs, business lunches or supplies.

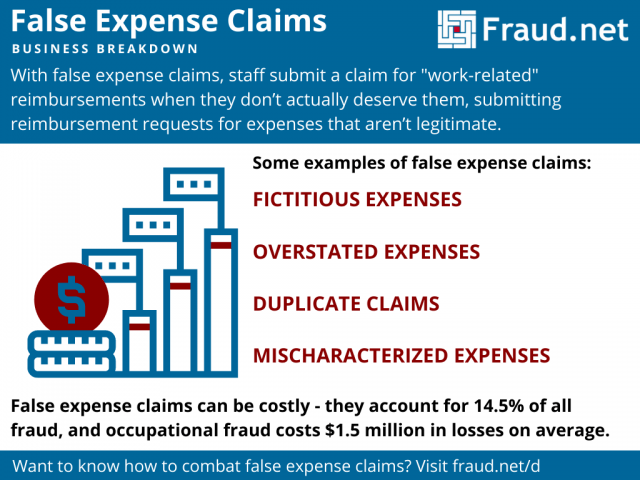

With false expense claims, staff – who are authorized to be reimbursed for a certain number of expenses incurred while carrying out their work duties – submit a claim for those reimbursements when they don’t actually deserve them. Essentially, they take advantage of this practice to submit reimbursement requests for expenses that aren’t legitimate.

This type of fraud can take on different forms:

- Fictitious expenses. Employees can use fake receipts or fill out blank receipts to claim they purchased something for work and get reimbursed. They can also submit a claim for trips they canceled.

- Overstated expenses. With overstated expense reports, employees claim they spent more than they actually did. They can, for instance, say they tipped more or fail to report that an item was discounted.

- Duplicate claims. It’s possible to use the same receipt or invoice more than once to submit multiple expense reports. This scheme can be hard to notice if your HR or accounting department is busy.

- Mischaracterized expenses. This scheme is one of the common types of false expense claims. Some mischaracterized expenses are legitimate errors because there are no clear policies for what the business will reimburse, but others are malicious claims from employees disguising personal purchases as business-related expenses.

How can false expense claims affect your business?

False expense claims are more common than you might think. After all, internal agents commit 37% of all fraud. Plus, 14.5% of all fraud is expense fraud. Indeed, it’s a costly issue since occupational fraud schemes cause $1.5 million in losses on average.

There are steps you can take to protect your organization from false expense reports, starting with reviewing your current policies for issuing reimbursements.

Stronger controls can make it harder to get past the employees who approve expenses. Having more than one employee involved, establishing who has the permission to issue a reimbursement, and escalating the request to a higher-level employee for claims above a certain amount can make it more difficult to submit false expense claims.

You should also go over your expense and reimbursement policies and update them. Create a list of allowable expenses and spending limits. Determine the reimbursement rate for mileage and list the documents employees will have to submit as proof. Review these rules regularly and adjust allowances to account for inflation.

Consider adopting company credit cards to oversee what employees spend instead of relying on receipts alone. You can also create a strong deterrent against internal fraud by implementing random audits of reimbursement requests.

Enforcing disciplinary measures if you find an employee to have submitted a false expense claim is another strong deterrent. Training can also increase awareness for this type of fraud and create a company culture where employees are more likely to report internal fraud.

False expense claims can be a costly issue. Besides, they can slow down the process of reimbursing legitimate business expenses. You can go further to save time and money by leveraging tech to create an additional layer of security.

How technology can help

You can build a more streamlined reimbursement process by doing away with paper receipts and adopting email to submit reimbursement requests. With Fraud.net’s Email AI tool, recipients will see a risk score for each email they receive and will know right away if a claim has been falsified.

Adopting our Transaction AI tool is another step you can take to protect your organization from false expense claims. This tool can detect fraudulent transactions by leveraging third-party APIs, our Collective Intelligence Network, and data from dynamic device fingerprinting to track users’ behaviors.

Don’t let false expense claims hurt your bottom line. Take action now and install Fraud.net’s Email AI for free. And don’t forget to take advantage of a free fraud analysis to create a stronger defense against all kinds of fraudulent activities.