What are Credit Card Refund Schemes?

Credit card refund schemes are fraudulent activities in which scammers exploit the refund process of credit card transactions to illegitimately obtain money or goods. In refund schemes, fraudsters employ clever strategies to obtain money or items that they shouldn’t rightfully have. They engage in deceptive tactics to manipulate the way refunds are processed. This allows them to receive money that they have no legitimate claim to.

Credit card refund schemes can lead to financial losses for businesses, financial institutions, and individuals.

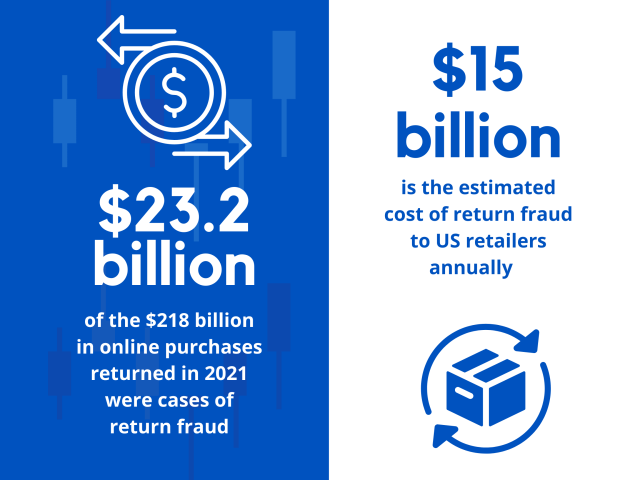

- Approximately $23.2 billion of the $218 billion in online purchases returned in 2021 were cases of return fraud

- Return fraud is estimated to cost US retailers over $15 billion in losses annually

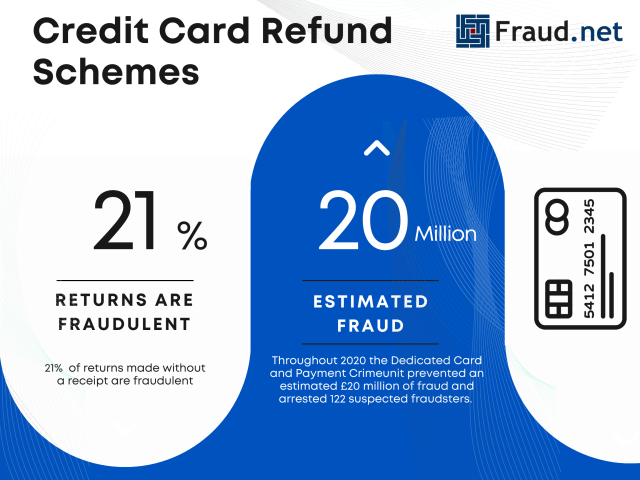

- 21% of returns made without a receipt are fraudulent

- The Dedicated Card and Payment Crime Unit protected an estimated £20 million from potential refund schemes and arrested 122 suspected fraudsters.

Common types of credit card refund schemes:

- Return Fraud: A fraudster purchases items using a credit card and then returns them for a refund, often claiming the items were defective or not received, even though they were never purchased.

- Overpayment Refund Fraud: The fraudster makes a larger payment than necessary and then requests a refund for the overpayment amount.

- Virtual Item Fraud: In online transactions, a fraudster may purchase virtual goods or services, claim they were never received, and request a refund.

- Collusion with Employees: Fraudsters collude with employees to process fake refunds and share the proceeds.

Credit card refund schemes differ from legitimate refund processes by involving deception or manipulation to obtain refunds that are not justified. Legitimate refunds are intended to rectify genuine errors or customer dissatisfaction.

Solutions for Refund Fraud

Mitigating credit card refund schemes involves a combination of strategies:

- Transaction Monitoring: Implement advanced analytics to detect patterns indicative of refund fraud, such as multiple refunds for the same item or excessive refund requests.

- Documentation Verification: Require detailed documentation for refund requests, including proof of purchase and reasons for the refund.

- Automated Fraud Detection: Utilize automated systems to cross-reference refund requests with historical transaction data and flag anomalies.

- Employee Training: Educate employees about common refund fraud tactics and how to identify suspicious refund requests.

- Refund Approval Process: Institute a multi-level approval process for refunds that involve high amounts or deviate from regular patterns.

- Customer Authentication: Implement strong customer authentication methods to verify the identity of the person requesting the refund.

- Data Sharing: Collaborate with industry partners and organizations to share information about known refund fraudsters and patterns.

Fraud.net’s Solution

Fraud.net offers an advanced fraud prevention solution with features tailored to combat credit card refund schemes:

Pattern Recognition, a crucial component, harnesses the capabilities of machine learning. By scrutinizing refund patterns and behaviors, this technology helps identify deviations that might suggest fraudulent activities. Transaction Analysis delves into historical transaction data. Its role is to meticulously sift through this data, aiming to uncover any irregularities or anomalies present within refund requests. This systematic examination contributes significantly to detecting suspicious activities and potential fraud.

Customer Verification stands as a pivotal safeguard in the refund ecosystem. It provides essential tools that enable organizations to verify the identities of their customers. This step is essential to ensure that refunds are direc

ted to the rightful recipients, preventing any illegitimate diversion of funds. The advantage of Real-time Monitoring cannot be overstated. It acts as a vigilant guardian, capable of issuing instant alerts when any suspicious refund activities are detected. This real-time notification system empowers organizations to intervene swiftly and prevent any further potential harm. Lastly, the importance of Industry Collaboration cannot be overlooked. A collective defense is established against evolving refund fraud tactics by fostering information sharing among different entities. This collaborative approach ensures that knowledge is pooled, enabling organizations to proactively adapt and counter emerging threats effectively.

We invite you to request a demo or consultation with our experts to explore how Fraud.net’s comprehensive fraud prevention solution can safeguard your business against credit card refund schemes and other fraudulent activities. Take proactive steps to protect your business’s financial integrity today.