From a business perspective, fraud is a broad legal category of wrongdoing. But what is it exactly?

The legal system so far has tried its best to categorize fraud into different subgroups, but in reality, things can still be confusing because of inexact and conflated terms.

You can’t prevent fraud unless your organization has a common understanding of what it is, and how it’s classified.

To that end, Fraud.net would like to propose a new, hopefully more elegant organization for comprehensive fraud.

A new fraud taxonomy

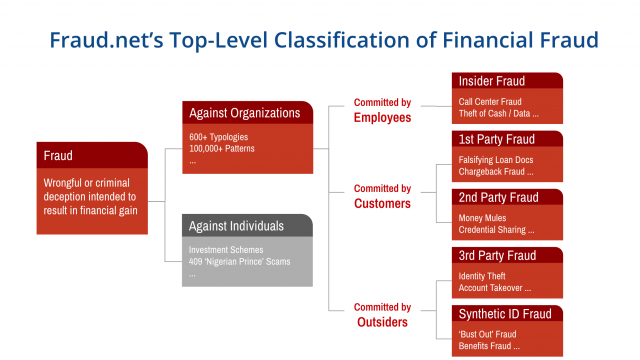

Our understanding of comprehensive fraud can be broken down into two major groups: fraud against organizations and fraud against individuals. Both are pernicious problems but we’re primarily concerned with fraud against organizations.

Within this group, there are then three sub-groups of fraud, which include fraud committed by:

- Employees.

- This is also called insider fraud. Examples include call center scams and cash/data theft.

- Customers.

- This could be first-party fraud, falsifying loan information, or friendly fraud.

- It could also be second-party fraud, like the use of “money mules” and credential sharing.

- Outsiders.

- This could be third-party fraud, like identity theft and account takeover.

- It could also be synthetic ID fraud, like “bust out” fraud, or benefits fraud.

Let us handle comprehensive fraud so you can better handle your business

Fraud.net is a leader in AI-powered enterprise risk intelligence. We’ve developed our new fraud taxonomy as discussed above for comprehensive AI fraud detection and prevention that helps classify and explain a number of the different types of fraud.

The Fraud.net platform, a cloud-based “glass-box” system, is the most advanced and intelligent option for comprehensive fraud prevention.

Unlike rules-based decision platforms, which fraudsters can reverse engineer, and unlike using multiple fraud vendors that are managed in silos and inefficient, Fraud.net’s platform is the only one in the fraud prevention space that offers machine learning fraud detection, as well as:

- Fastest time to impact – Uber-modular, cloud-born architecture that enables customization and deployment within 90 days.

- Data integration – Ability to easily integrate virtually any third-party data source into fraud models and case management – e.g., access data from multiple vendors in a single screen when reviewing a fraud case.

- Enterprise case management – Case management with enterprise capabilities such as workflows and permissions at the team and individual levels.

- Advanced business intelligence – Tableau-like data mining and visualization.

In summary, comprehensive fraud requires sophisticated solutions. Fraud.net can help.