What is 3rd Party Fraud?

Refers to any fraud committed against a financial institution or merchant by an unrelated or unknown third-party.

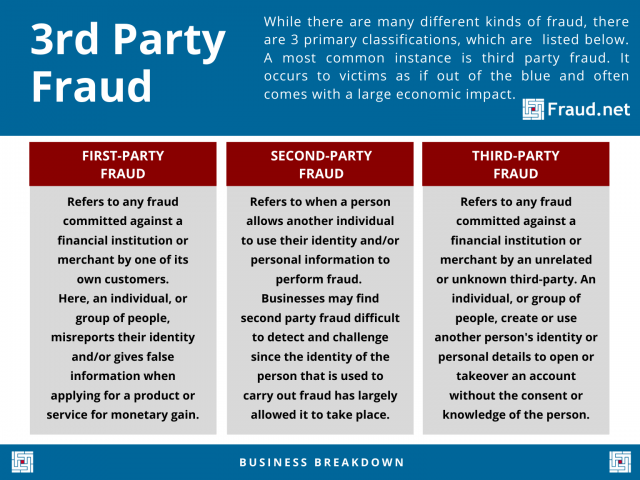

While there are many different kinds of fraud, there are 3 primary classifications, which are listed below. A most common instance is third party fraud. It occurs to victims as if out of the blue and often comes with a large economic impact.

Differentiation

- 1st Party Fraud refers to any fraud committed against a financial institution or merchant by one of its own customers.

- Second party fraud, or money mules, is where a person allows another to use their identity or personal information to perform fraud. Businesses may find second party fraud difficult to detect and challenge since the identity of the person that is used to carry out fraud has largely allowed it to take place.

- 3rd Party Fraud refers to any fraud committed against a financial institution or merchant by an unrelated or unknown third-party, and has a multitude of classifications.

Common Types of 3rd Party Fraud

- Account takeover fraud (ATO) – a form of identity theft in which a criminal gains control of a consumer’s account. In doing so, the perpetrator gains access to confidential information such as the consumer’s PIN. This enables them to change account settings, such as addresses or passwords, and can even allow unauthorized withdrawals. ATO can involve one or many of a victim’s accounts. This includes bank, brokerage, phone, utility, social media, travel or online shopping accounts. Financial account takeover usually removing funds from victim’s accounts. This is done either by direct debit, payments or transfers being set up for fraud without the victim’s knowledge or consent.

- Synthetic Identity Creation – represents the process of creating a false identity. Synthetic Identity Creation (SIC) is a generic term. Consequently, it shows how fraudsters collect information about real people and manipulate their identities. With false and fabricated information, a new identity is assigned to no actual real-life person. A great deal of fraud stems from this process.

- False Identity Fraud – a situation where a person creates a fake identity to commit criminal activities. Actions that are examples of identity fraud are making a credit card, submitting for a loan, or opening bank accounts.

- Credit Card Fraud – refers generally to any fraudulent transaction using a credit card as a source of funds. Credit card fraud may occur simultaneously with identity theft, but can also occur when a legitimate consumer makes a purchase with no intention of paying for the goods or services, sometimes referred to as chargeback fraud or friendly fraud.

- New Application Fraud, in which a perpetrator applies for a credit card in a victim’s name, then uses the card to purchase goods and services illegally.

Protecting Your Business

At Fraud.net, our mission is to make every digital transaction safe. Our award-winning fraud detection platform helps digital businesses to quickly identify 3rd party fraud using artificial intelligence, big data and visualizations, and combat hard-to-detect fraud at digital enterprises. Its unified algorithmic architecture combines: 1) cognitive computing/deep learning, 2) collective intelligence, 3) rules-based decision engines, and 4) streaming analytics to detect fraud in real-time, at scale.