In industries like retail, where business is moving from brick-and-mortar stores to online shopping, companies need to adopt new strategies for verifying customers’ identities.

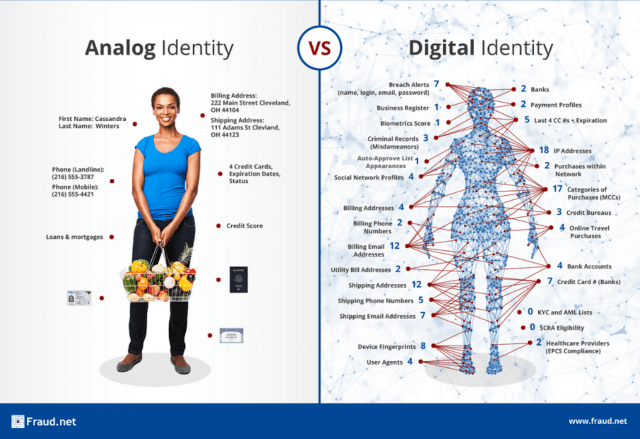

A customer’s physical, or analog, personal identity can usually be verified during a direct interaction with a representative. For example, you could easily cross-reference the name on the customer’s credit card with their ID. With this, you ensure that the photograph on their ID depicts the person standing in the store.

However, the lack of direct contact during online transactions in the digital world makes analog identity attributes obsolete for preventing fraud. To address this problem, businesses can reduce fraud by relying on digital attributes and footprints to authenticate online identities.

What is a digital identity?

A digital identity (digital ID) is a set of attributes associated with a user to represent them in a digital setting.

Digital systems rely on these attributes to authenticate users. Successful authentication takes place when a user shares sufficient attributes to verify who they claim to be.

Authentication requirements vary from one system to another:

- A message board would rely on digital attributes (unique identifiers) like a username, email address and password.

- A social media network might use an additional attribute like physical access to a device where users can receive a one-time password.

- A shopping site would focus on payment-related and location attributes. They ask for a credit card security code and check the user’s IP address.

- A government agency like the IRS would use a wider range of attributes. For instance, this might include user’s personal information such as Social Security Number and questions about their credit history.

The shortcomings of digital identity attributes

Verifying a user’s digital identity during a transaction isn’t easy because it’s possible to mimic common attributes of digital identity. Verifying attributes like names, email addresses or phone numbers isn’t sufficient in the context of fraud prevention.

In fact, criminals can spoof a digital identity by taking advantage of assigned attributes that merchants typically check.

They create new email addresses with the names of identity theft victims, or take over existing usernames by stealing passwords. Or, they use another person’s name and billing address if they’re committing credit card fraud.

As such, it’s crucial to check more than just emails and passwords in your fraud prevention strategies to avoid potential data breaches.

Going beyond assigned attributes with digital footprints

A digital footprint is the sum of a user’s online activities and habits. Using digital footprints for authentication is an excellent way of preventing fraud because these activities and habits are difficult to spoof.

You can collect data about users to put together a more accurate picture of their identity and habits. Consider using data about login times and locations, IP addresses, order information, and other online activities.

A digital footprint reflects a user’s behaviors over a period of time to establish a pattern. That pattern gives you an accurate idea of their typical online behaviors. It’s difficult to mimic a digital footprint because it relies on several attributes that form a pattern.

In fact, investigating a user’s digital footprint can uncover fraud. Here are a few scenarios when assigned attributes might not look out of place, but the digital footprint reveals something unusual:

- The user’s IP address or location isn’t the same as usual because a criminal took over their account.

- The same device is used to log into several accounts associated with different usernames and email addresses.

- A single IP address is used to create several new accounts over a short period of time.

- The same credit card is used to make purchases with different accounts and email addresses.

- The shipping address doesn’t match the IP address.

These scenarios illustrate that relying on digital identity attributes isn’t enough to prevent fraud.

The best way to ensure that a user’s digital identity matches their analog identity is to look at the broader picture and use data associated with their digital footprint.

How to analyze a user’s digital footprint

You can track and analyze a user’s digital footprint by implementing a deep learning fraud prevention solution. This technology will enrich the digital identity attributes you collect at checkout and give you a more accurate picture of a user’s identity.

The advantage of deep learning is that it can leverage data from past activities and transactions.

If someone has used your site before, you’ll be able to analyze data from their digital footprint and find a pattern. Any deviation from this baseline is a red flag that should be investigated.

Furthermore, deep learning lets you analyze a large number of variables and assess risks for each transaction. Besides evaluating the likelihood of fraud, a deep learning solution can make a real-time decision and opt against processing a transaction if too many variables look out of place.

Learn more

Relying on assigned attributes to verify a user’s digital identity isn’t sufficient. Criminals can easily mimic these attributes.

Additionally, focusing on attributes like usernames and email addresses will rarely reveal inconsistencies.

The best way to verify users’ identities is to deploy a deep learning solution that can analyze a user’s digital footprint. These solutions look for patterns and assess the likelihood of fraud based on relevant variables.

To learn more about how you can use digital footprints in your fraud prevention strategies, contact Fraud.net to schedule a demo today.