What are write-off schemes?

Accountants use write-offs to report depreciation of the value of an asset or to indicate a loss so that the business doesn’t pay taxes on an asset that has a lower value. So, a write-off is an accounting action that reduces the value of an asset while simultaneously debiting a liabilities account without having proper approval.

It is primarily used in its most literal sense by businesses seeking to account for unpaid loan obligations, unpaid receivables or losses on stored inventory. Generally, it can also be referred to broadly as something that helps to lower an annual tax bill.

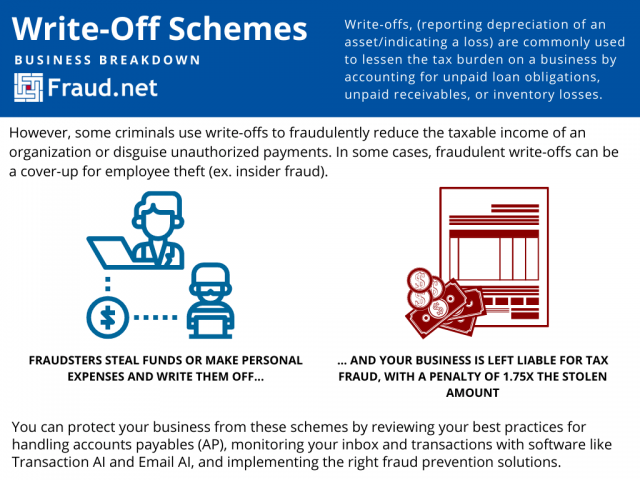

However, some criminals use write-offs to fraudulently reduce the taxable income of an organization or disguise unauthorized payments. In some cases, fraudulent write-offs can be a cover-up for theft. (For example, an employee may siphon money out of a business and conceal it as a loss.)

How do write-off schemes affect your business?

Unscrupulous employees and entrepreneurs can use write-offs to claim personal expenses as business deductions. Think hotel stays, restaurant meals, and even vehicle use.

In more serious cases of internal fraud, criminals can use write-offs to hide the fact that they’re authorizing payments to an accomplice or diverting funds and reporting a corresponding amount as bad debt.

On average, it takes more than a year to notice internal fraud schemes. This means write-offs can add up and dangerously increase your risks of an IRS audit.

If the IRS finds your organization guilty of tax fraud, you will be responsible for the unpaid taxes as well as a penalty of up to 75% of the unpaid taxes.

How to prevent write-off schemes

You can protect your business from these schemes by reviewing your best practices for handling accounts payables (AP) and implementing the right fraud prevention solutions.

Tracing and screening transactions

You can make schemes harder to implement by designing a safer AP process:

- Automation can reduce manual tasks and the potential for tampering with the AP process.

- Strong payment controls can avert unauthorized payments, the use of another receipt to hide misappropriation, and false reports of bad debt.

- A clear separation of duties prevents employees from authorizing fraudulent payments or reporting fake write-offs. One person should handle payments and another handle invoices.

- Adopting best practices for reporting suspicious activities will make you more proactive and foster a culture of ownership and responsibility.

Transaction AI

Fraud.net offers a transaction and AML monitoring solution that uses AI to spot suspicious transactions, including unauthorized payments.

This system looks at millions of data points to improve your visibility, including data from:

- A collective intelligence network.

- Device IDs.

- Data from third-party APIs.

The data goes through a customized machine learning model that issues a risk score for each transaction. Your fraud prevention team can then manually review flagged transactions through a case management portal.

Email AI

Because accounts payables are often targets of write-off schemes, you can mitigate risks by protecting the accounts payable mailboxes.

Email AI is a fraud prevention solution that leverages multiple data points to issue a risk score for each email. It tells recipients whether they can trust a payment request.

However, write-offs are only one of the fraud types that target emails. Because internal fraudsters know about your AP process and the vendors they typically work with, fake invoices used as part of a write-off scheme can be particularly challenging to spot without the help of AI.

With 92% of businesses being targeted by business email compromise schemes in the past year, Email AI is a must-have fraud prevention tool.

How Fraud.net can help

Internal fraud can take on many forms, including fake write-offs. Besides facing steep fines from the IRS and other legal consequences, your business’s bottom line could be seriously affected by write-off schemes, especially if they’re a cover for employee theft. With solutions like Transaction AI and Email AI, Fraud.net can make you more resilient against insider fraud, write-off schemes, and fake invoices.

Contact us for a free fraud analysis to give you a better idea of how to protect your bottom line.