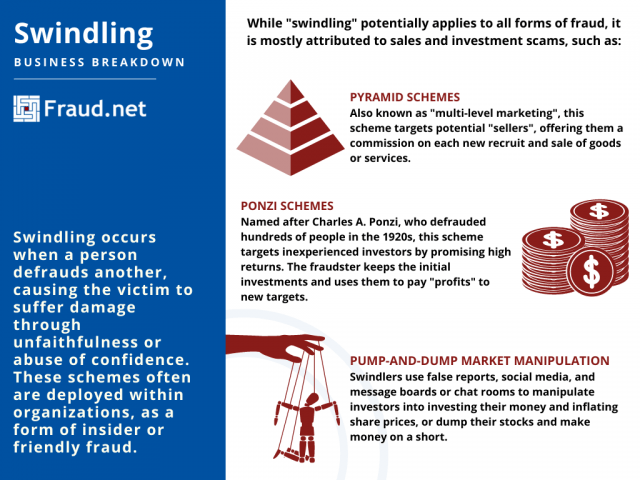

The term ‘swindler’ refers to a person who takes advantage of others through deceit. Swindling occurs when a person defrauds another, causing the victim to suffer damage through unfaithfulness or abuse of confidence. Swindling can be committed by a group of people or individuals involved in defrauding actions to get financial benefits or property by exploitation or fraud. These schemes often are deployed within organizations, as a form of insider or friendly fraud.

While “swindling” potentially applies to all forms of fraud, it is mostly attributed to sales and investment scams, such as:

Ponzi Schemes

Named after Charles A. Ponzi who defrauded hundreds of people in the 1920s, this scam targets inexperienced investors by promising high rates of return. A “promoter” offers to pay an initial investor their principal plus the rate of return, and in order to pay those “returns”, targets other investors. Then, more investors become interested because the opportunity seems legitimate and profitable, putting their money into the scheme.

The initial promoter never invests the principal amount, instead siphoning off funds from the investors’ initial investments. They pay off “profits” using funds from other investors, and the chain continues until the promoter disappears and the scheme collapses.

Pump-and-Dump Market Manipulation

This scheme is a form of market manipulation, in that the swindler employs this to inflate or deflate prices to earn a profit. Swindlers use false reports, social media, and message boards or chat rooms to manipulate investors into investing their money and inflating share prices, or dump their stocks and make money on a short.

Market manipulation is illegal, and many investors actually lose money in the process.

Pyramid Schemes

In these, the original buyer or swindler obtains the right to enlist others in the “marketing process”. This marketing process is most recognizable in beauty product pyramid schemes, in which each seller obtains a supply, and with every buyer and new investor, earns a commission. While this method, also known as “multi-level marketing”, isn’t technically illegal, the method of recruiting and the language of potential profits mirror those of other swindling schemes. The recruiting method also mirrors that of a Ponzi scheme, in that the most profits come from recruiting new members rather than the product or investment.

These schemes frequently target people in affinity groups (people with shared interests or beliefs), as they often find it easier to recruit investors within these groups.

Fraud.net vs. Swindling

Fraud and swindling are illegal in the US with Title 18 US Code § 1341, which states that those found guilty of fraud are punished with up to 20 years of imprisonment, or a fine of one million dollars. Despite this codification, many businesses choose to mitigate fraud rather than prosecute it. Often, it is easier to mitigate due to the volume of fraud attacks, than prosecute and seek damages.

For this reason, many businesses and institutions employ preventative measures through fraud detection and prevention services. In combination with security best practices training, institutions (and consumers) can avoid being targeted by these schemes or losing money due to dishonest investment recommendations.

Fraud.net offers a wide variety of security solutions to combat money laundering and insider fraud, among other issues. Contact us for a free demo today, and recommendations for fraud prevention.