How to Avoid Losing Money to a Romance Scammer

Millions of people fall victim to romance scams, or fraudsters portraying themselves as potential romantic partners only to trick their mark into sending them their money. Scammers create fake profiles on dating sites or social media and strike up a conversation to build trust. Then, they make up a story and ask for money or threaten the victim with blackmail.

They may request money for plane tickets to meet the victim, or pay for medical or legal expenses or a visa. On the other hand, they may threaten the victim with messages about compromising photos, or sharing sensitive information with friends and family on social media and offer to stand down in exchange for payment.

Scammers request this money to be wired through payment services or through reload or gift cards for vendors like Amazon, and often, the victim believes the ruse and pays the amount. Unfortunately, once they realize the scam, these transactions are usually impossible to reverse or track, and the victim loses hundreds of dollars. The payment company or the gift card issuer now shoulders the burden.

The Cost of Romance Scams

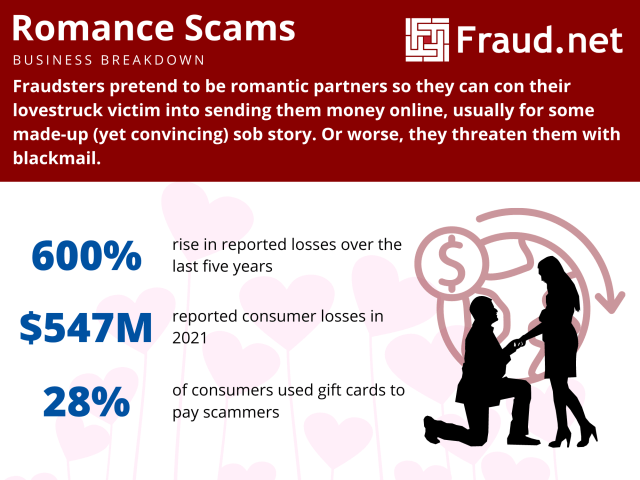

These scams cost consumers upwards of $304 million in 2020 and have risen to a record $547 million in 2021, and reported losses increased by 600% from $87 million in 2017. In the last five years, the cost of romance scams increased to $1.3 billion, more than any other type of fraud.

The most profitable avenue for fraudsters to conduct romance scams is social media, with consumers reporting losses of $770 million in social media fraud schemes. The top platforms for conducting these scams were Facebook and Instagram.

Furthermore, the largest reported losses were paid in cryptocurrency, reaching a staggering $139 million in the last year alone, 25 times the numbers reported in 2019. Gift cards were the most prominent payment method for these scams, with 28% of people reporting the use of these. Losses with this method amounted to $36 million last year.

This rise could be attributed to the increased digital presence and lack of face-to-face interaction due to the pandemic. However, presence on dating apps and sites increased outside of the pandemic as well.

What do Romance Scams Have to Do With My Business?

These scams are essential for businesses to note as they are a remittance issue that affects merchants, payment companies, and platforms.

Once the scammer obtains wired funds, the onus of the loss now falls on the transfer service platform, the merchant who hosts that transfer service (or sells the gift cards), or the payment service provider who hosts the victim’s payment account or issues their card. So, this issue results in increased chargebacks and disputes, and companies must screen these on top of their usual burden for fraudulent chargebacks.

Additionally, romance scams can manifest as an email fraud issue, as victims may fall prey to phishing emails. Or, the fraudster may ask them to enter credentials on a spoofed or dangerous site. Romance scams could also manifest as an insider fraud issue through blackmailing the victim into committing cybercrime in exchange for withholding sensitive photos or information from social media sites.

Combat Romance Scams with AI

The best way to combat the effects of romance scams is to employ a strong fraud defense, with comprehensive risk detection and analysis. Flagging suspicious activity, employing verification tools for identities and transactions, and monitoring chargebacks will ultimately save both you and your customers from romance scammers.

With our award-winning AI-powered risk management ecosystem, run checks for suspicious transactions quickly and accurately. Screen for inconsistencies within accounts, verify recipients against billions of data points, and bolster your fraud protection to give both you and your customer peace of mind.

To discover how Fraud.net can help you combat payment or remittance fraud, email fraud, or provide award-winning insider threat detection… schedule a free demo of how our fraud-prevention software can accurately flag fraudsters on autopilot.