Fraud Ring

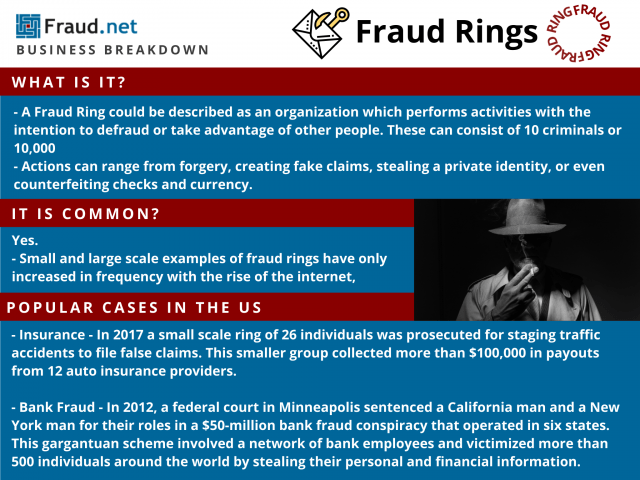

A Fraud Ring could be described as an organization which performs activities with the intention to defraud or take advantage of other people. This organization might be involved in any kind of forgery. Actions can range from creating fake claims, stealing a private identity, or even counterfeiting checks and currency. Some rings are devoted to committing fraud against ecommerce websites. Others are devoted to defrauding charities, businesses or government agencies. These organizations can consist of 10 criminals or 10,000. Most are devoted to committing specific types of fraud.

With the rise of the internet, online fraud is rampant. Millions of consumers are filling out online forms that require them to submit personal information, including as credit card numbers, SSIDs, street addresses, etc. Consequently, identity theft is the most popular type of Internet fraud.

Methods Used by Fraud Rings

There are many known cases of organizations that have carried out insurance fraud. For example, in 2017 a small scale ring of 26 individuals was prosecuted for staging traffic accidents to file false claims. This smaller group collected more than $100,000 in payouts from 12 auto insurance providers.

Payouts can be much larger. In 2012, a federal court in Minneapolis sentenced a California man and a New York man for their roles in a $50-million bank fraud conspiracy that operated in six states. This gargantuan scheme involved a network of bank employees and victimized more than 500 individuals around the world by stealing their personal and financial information. Bank fraud rings like this one may steal large quantities of checks and forge signatures. They may complete false loan applications or use stolen credit card numbers. Additionally, identity thieves steal personal information to apply for bank accounts or debit cards.

Protection Against Organized Fraud

The Association of Certified Fraud Examiners estimates that total global fraud losses total nearly $5 trillion, and fraud rings are a large part of this. A large group working towards organized fraud can do more financial damage than any individual fraudster ever will. The more individuals added, the more complex the issue becomes.

With that said, complex problems require sophisticated solutions. Many companies thus integrate a digital risk management platform into their workflow to combat fraud at minimal costs. This enables your company to extract immediate value and gain transparency, confidence, and clarity. Make the effort to prevent this type of fraud from affecting your business.

Learn More

Contact us for a demo and recommendations for fraud prevention and identity protection.