Just as fraudsters are becoming more sophisticated in their attacks, so too are the ways companies can protect their data. According to the Association of Certified Fraud Examiners’ Report to the Nations, organizations that use proactive data monitoring can reduce their fraud losses by an average of 54% and detect scams in half the time.

Big data analytics is changing the way companies prevent fraud. AI, machine learning, and data mining technologies are being used in tandem to counteract the hydra of fraud attempts impacting more than 3 billion identities each year.

In summary, big data analytics techniques can help identify patterns of fraudulent activity and provide actionable reports used to monitor and prevent fraud—for businesses of all sizes. Here’s how.

What is big data analytics?

First, some context: In the past, companies relied on manual reviews and employee tips to uncover fraud. Unfortunately, audits and whistleblower reports often reveal fraud after the fact—meaning the scam has already succeeded. The manual process of seeking out fraud is also time-consuming, error-prone, and ineffective, missing many instances of fraud that could have been prevented.

Big data analytics completely revolutionizes this process. Big data analytics refers to the process of examining large and complex data sets to uncover patterns, correlations, and other useful information that can inform business decisions. This process uses specialized software and algorithms to analyze massive amounts of data from various sources to spot signs of fraud.

Big data analytics is a broad practice used across a number of business functions. Using different types of data, companies can improve their operations, reduce costs, and increase profits. In this case, we’re specifically focusing on fraud analytics and risk analytics.

What are fraud analytics and risk analytics?

Fraud analytics is the process of using data analytics to identify and prevent fraud. It involves collecting and analyzing large amounts of data to identify patterns and anomalies that may indicate credit card fraud, identity theft, insurance fraud, and other possible crimes

Similarly, risk analytics uses data analytics to identify, assess, and manage risks. The process includes collecting and analyzing large amounts of data to identify potential risks, assessing the likelihood and impact of those risks, and developing a strategy to mitigate the highest-priority risks.

The biggest advantage of big data analytics, and fraud and risk analytics accordingly, is that it facilitates the use of large and complex data. Faster decisions can be made in real time using data analytics techniques. Ultimately, thanks to big data analytics, a company can better understand customer requests and flag those it deems suspicious.

What are the key characteristics of big data?

The key characteristics of big data are often referred to as “the 3Vs”: volume, velocity, and variety. These characteristics define the unique nature of big data and present challenges and opportunities for data analysis and decision-making.

- Volume refers to the quantity of data available for analysis;

- Velocity is the measure of how fast the data is coming in;

- And Variety refers to the diversity of data available.

The job of big data analytics is to derive one last V from all this information: value. Big data analytics can help businesses make better decisions by providing insight into their customers, operations, and market opportunities. This practice can reveal where a company can work more efficiently and save money. And, it can help protect customer and business data from fraud and risky transactions.

How can big data analytics help prevent fraud?

Successfully harnessing big data requires robust infrastructure, advanced analytics techniques, and skilled professionals to process, analyze, and derive insights from large and diverse datasets. These assets combine to identify patterns and anomalies that could be signs of fraudulent behavior.

Big analytics can help prevent fraud using a variety of techniques, such as data mining, machine learning, and anomaly detection. For example, data mining can be used to identify patterns of fraudulent activity, such as using stolen credit card numbers or making multiple small payments in a short period of time. Machine learning can be used to build models that can automatically detect fraudulent activity. Anomaly detection, such as device intelligence, can identify when a malicious bot, fraudster, or other bad actor is present on your site.

More specifically, here are some examples of how big data analytics can help prevent fraud:

- Identifying patterns of fraudulent activity, such as using stolen credit card numbers or making multiple small payments in a short period of time.

- Detecting anomalies in data, such as if a customer suddenly starts making large purchases that are out of character with their normal spending patterns, or accessing their account from an unknown device.

- Building fraud detection models that can automatically identify fraudulent activity. These models are typically trained on historical data and can be used to scan new data for signs of fraud.

- Mitigating fraud risk by identifying and addressing the root causes of fraud. For example, if fraud is occurring because customers are reusing passwords, big data analytics can be used to identify these customers and require them to change their passwords.

Capturing these benefits takes the right tools and implementation. Fraud.net offers an award-winning fraud prevention platform to help digital businesses quickly detect transactional anomalies and pinpoint fraud using artificial intelligence, big data, and live-streaming visualizations.

[WATCH Video: Fraud Prevention Analytics]

In addition to the right tools, there are some key best practices for getting set up with big data analytics and improving your organization’s risk management.

Best practices for analytics in risk management

Big data is challenging because of its inherent nature: it’s big. Risk analytics requires a large amount of data, and it can be difficult to collect all of the data that you need. Likewise, the data can be very complex, and without the right implementation, teams often struggle to find the patterns and anomalies that indicate risk.

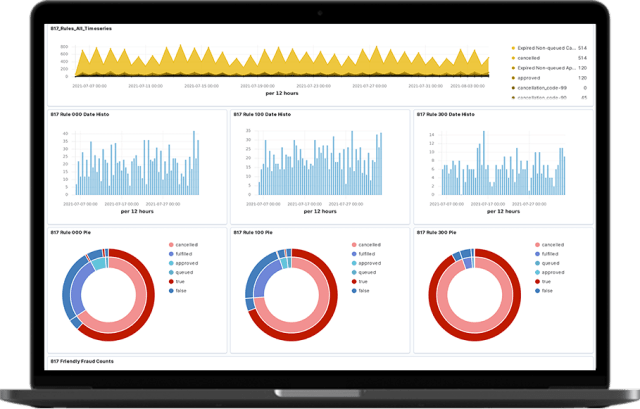

A risk management dashboard can help. This is a visual representation of an organization’s risk profile—used to track and monitor risks, identify trends, and make informed decisions about risk mitigation. Here’s an example of one:

Fraud.net can help set up a customized fraud management and prevention dashboard for your company. Start by choosing from our library of hundreds of pre-built reports. Combine multiple data streams into easy-to-understand charts and graphs, and get real-time reports and presentation-ready charts with just a few clicks. With Fraud.net’s advanced, robust data analytics and mining platform, companies can run reports, identify trends, and leverage live-streamed visualizations.

Fraud.net also provides a way to assess whether your fraud management strategy is working. Fraud.net Case Management provides a way to manage your fraud team more efficiently and effectively with customizable tools that automate and expedite your fraud investigations.

Capture the frequency and severity of fraud so you can identify and address issues before they become problems. And, discover how different rules and manual decisions are performing amid changing market conditions. This way, you can quickly make adjustments to stay ahead of the fraudsters.

Learn more about Fraud.net’s suite of big data analytics tools—sign up for a free demo today.