Digital companies and financial institutions continue to scramble in their efforts to prevent Synthetic Identity Fraud.

Legacy fraud prevention techniques and tools are inadequate against this challenging fraud deployed by increasingly technology-savvy criminals. Fraud.net has the arsenal of AI-based software, collaborative tools, and advanced analytics to tame this most perplexing of fraud schemes.

Where to Start

Fighting Synthetic Identity Fraud requires more than traditional fraud prevention measures. Tools like Know Your Customer, Customer Identification Program, and others are not sufficient for you to catch these criminals. Due to the composite nature of the fraud, those approaches alone will miss the mark. Preventing your company from being a victim requires advanced technologies and multiple tools working in tandem.

Your initial efforts need to be focused on an agreed-upon definition of Synthetic Identity Fraud and the capture of more granular applicant data. For sustainable detection and prevention, it takes a combination of defenses:

- Consistent Definition – Ensures proper categorization and avoids resorting to bad debt write-offs that obfuscate the issue.

- Data Granularity – Requires a more granular capture of data at account opening and throughout the customer journey.

- Technology Innovation – Advanced AI-based solutions are required to help detect this slippery fraud.

- Identity Verification – Robust and modular data-based tools for creating more identity proofing layers.

- Collaboration – Increased collaboration and data sharing between companies and government entities.

- Employee and Customer Awareness – Consistent cadence of training to inform and update regarding latest variants.

A Highly-configurable Synthetic Identity Fraud Detection & Prevention Solution

A unique fraud type requires multiple tools and technologies to detect and prevent attacks. Fraud.net’s Application AI product, along with our complementary tools, can form your bulwark against the rising tide of Synthetic Identity Fraud.

Powerful Solution to Expose Synthetic Identity Fraud

Our solution is built around the Application AI product and utilizing your abundance of customer data along with our curated external data sources to provide your company with new insights. This intelligence empowers your organization to more quickly and accurately spot potential cases. As a result, Fraud.net’s tools provide your organization with increased brawn to stop the fraudsters:

- Improved orchestration of detailed customer and event data to eliminate time spent gathering siloed information.

- Collective Intelligence Network to enhance collaboration through an anonymized data consortium. Provides your company with critical fraud intelligence from similar organizations.

- Custom machine learning models automatically adapt the systems’ approach to new schemes and variants.

- Application AI improves account authentication without sacrificing a frictionless customer experience. It analyzes vital identity factors during account creation, cross-verifies critical identity data, and flags potential high-risk behavior.

- Linked Entity Analysis with our advanced visualization tools analyzes an individual’s connections, relationships, and behaviors for faster detection of anomalies to pinpoint false identities.

- Dynamic Device Fingerprinting captures the device ID used for the application to detect bots, proxies, and other potentially fraudulent activity. Additionally, it assesses user behavior and other contextual information to create a unique digital fingerprint.

- Our Appstore seamlessly integrates and utilizes other relevant software providers into your custom solution. It provides quick access to dozens of data vendors and technology partners through APIs in seconds without the usual technical hassles and maintenance costs.

- Case Management Portal to improve the effectiveness of your fraud team. Creates and manages thousands of industry-specific risk rules and workflows.

- Actionable Analytics and Reporting Portal provide visualization of fraud trends and the ability to monitor events in real-time with easily configurable charting tools.

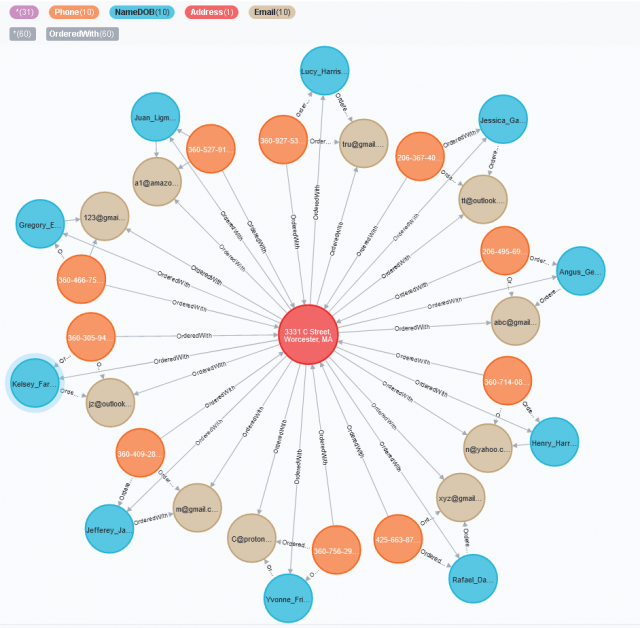

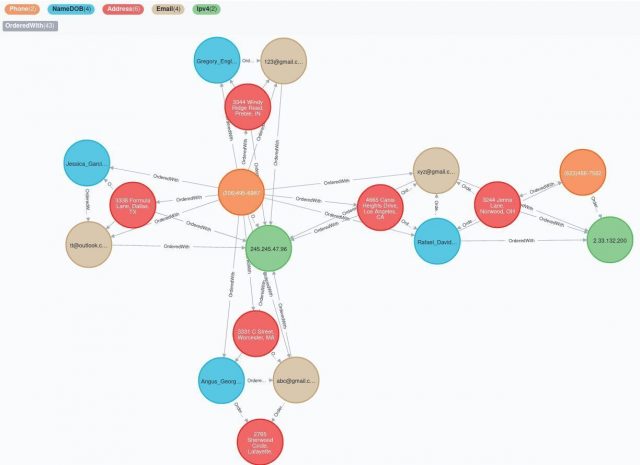

Fraud.net’s visualization tools help to bring your data to life. These graphics are examples of identity clustering, showing identity elements related to transactions.

Legitimate Identity Clusters

- This visualization shows an example of a likely legitimate hub cluster.

- In this example, many ID clusters share a common Address.

- ID sharing is common and occurs in legitimate contexts frequently.

- For an Address, sharing can occur with apartment buildings, drop shippers, call centers, or other examples.

Likely Fraudulent Hub Cluster

- This visualization depicts identification sharing.

- Many identity clusters share a common Phone and IP address.

- Phones are commonly shared identifications in fraud schemes.

- This cluster is an example of a highly probable case of Synthetic Identity Fraud.

Client Success Story

We recently partnered with a leading U.S.-based provider of point-of-sale payment options for a Synthetic Identity Fraud detection and prevention solution. Our focus was analyzing micro-loans to high-risk individuals for scoring potential risk from synthetic identities.

Solution:

To score the potential risk, we developed an enriched data set with 500+ identity and behavioral attributes to create a custom deep neural network. Based on our analysis, we provided recommendations on risk scoring bins and thresholds for applicants of lease-to-own loans. We then provided the client with their potential customer’s risk score through our Case Management portal for appropriate action.

Outcome:

The outcome of our risk scoring analysis and timely delivery of risk scores was a significant reduction in Synthetic Identity Fraud for the client. With our Collective Intelligence Network and AI-based tools, we helped them approve more trustworthy applicants while isolating more risky ones with 40% more accuracy.

As a result, the engagement delivered a 100+% ROI for the client.

Fighting Synthetic Identity Fraud with Fraud.net

With better utilization of existing applicant and customer data, along with incorporating relevant external data, organizations can push back against the growing problem of Synthetic Identity Fraud. Fraud.net’s comprehensive fraud solutions provide financial institutions and digital organizations of all sizes with a leading-edge tool to detect and prevent Synthetic Identity Fraud.

To find out more about fighting Synthetic Identity Fraud, please read our eBook “Why AI and Collective Intelligence are Critical to Exposing Synthetic Identity Fraud” and contact us today to talk with one of our experts and receive a free demo.